How Smonik Excels at Processing Your Tax Forms

Smonik is known to process alternative investment documents quickly and accurately, but did you know its powerful capabilities can also handle complex tax forms, such as K-1’s and 1099’s? With the ability to retrieve relevant files, extract necessary data, and transform the data into any format, it can ease the burden of processing any form. However, it’s Smonik’s robust reconciliation solution that sets it apart when processing taxes. With the power to reconcile any multiple of data sets, Smonik ensures the accuracy of complicated tax forms.

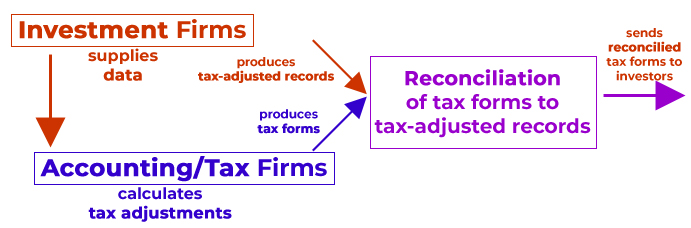

The crucial data necessary to complete tax forms must undergo an arduous journey. Investment firms gather relevant figures from their records and supply them to accounting or tax firms. This process is often performed manually, making it time-consuming, strenuous, and subjected to costly human error. The accounting or tax firms then calculate tax adjustments and produce the forms (K-1’s, 1099’s, etc.) This can also be fraught with danger, as precise calculations are essential. The data in the forms is then compared with the investment firm’s tax-adjusted records and must be identical. Any inaccuracies can be detrimental to everyone involved.

No matter where you are in the tax processing journey, our turn-key service, SMONIK AUTOMIK, can help. SMONIK AUTOMIK can automatically collect the necessary files and extract specific data from any structure, no matter how complicated. The extracted data can be formatted in any output format, simplifying integration with an internal or external application. Most importantly, Smonik’s ability to reconcile any two data sets with precision makes it an invaluable asset when validating tax figures. Whether you are preparing, adjusting, reconciling, or submitting the data, you can be confident the results are accurate with Smonik.

No matter where you are in the tax processing journey, our turn-key service, SMONIK AUTOMIK, can help. SMONIK AUTOMIK can automatically collect the necessary files and extract specific data from any structure, no matter how complicated. The extracted data can be formatted in any output format, simplifying integration with an internal or external application. Most importantly, Smonik’s ability to reconcile any two data sets with precision makes it an invaluable asset when validating tax figures. Whether you are preparing, adjusting, reconciling, or submitting the data, you can be confident the results are accurate with Smonik.

Contact us to learn more about the SMONIK AUTOMIK service offering as it relates to processing complex tax documents or click Chat below if you have any questions.